*

1. Introduction (Muqadma):

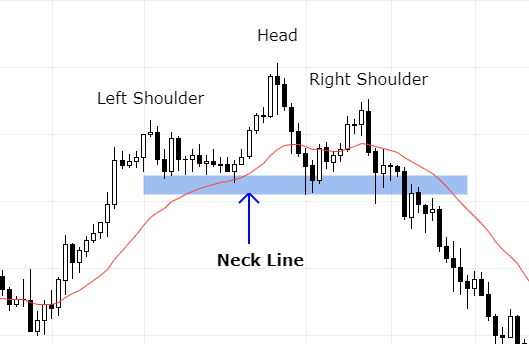

Head and Shoulder candlestick pattern ek technical analysis concept hai jo market trends ko identify karne mein istemal hota hai. Yeh pattern market mein trend reversal ko represent karta hai aur traders ko potential trend change ke baare mein agah karta hai.

2. Head and Shoulder Ka Tareeqa (Formation of Head and Shoulder):

Head and Shoulder pattern ek specific sequence mein hota hai. Is pattern mein teen major parts hote hain: left shoulder, head, aur right shoulder. Left shoulder mein price ek peak tak pahunchti hai, phir ek temporary decline hota hai (jabki head ban raha hota hai), aur phir price dobara upar jaake right shoulder banata hai.

3. Left Shoulder (Baayein Kandha):

Head and Shoulder pattern ki shuruwat left shoulder se hoti hai. Is phase mein price ek high point tak pahunchti hai aur phir thoda sa decline hota hai. Yeh decline left shoulder ki formation ko complete karta hai.

4. Head (Sar):

Head left shoulder ke baad aata hai. Is phase mein price ek higher peak tak pahunchti hai compared to the left shoulder. Head ka formation left shoulder ke neeche hota hai aur is phase mein volume bhi barh sakta hai.

5. Right Shoulder (Daayein Kandha):

Head ke baad right shoulder aata hai. Is phase mein price dobara ek peak tak pahunchti hai, lekin is peak left shoulder ke peak se kam hoti hai. Right shoulder ke formation ke baad ek aur decline hoti hai.

6. Neckline (Gardan Rekha):

Head and Shoulder pattern ka ek important element hai neckline. Neckline ek imaginary line hoti hai jo left shoulder ke low point se lekar right shoulder ke low point tak jati hai. Agar price is neckline ko break karti hai, toh yeh trend reversal ka signal ho sakta hai.

7. Confirmation (Tasdeeq):

Head and Shoulder pattern ko confirm karne ke liye traders ko price ka breakout ka wait karna hota hai. Agar price neckline ko neeche break karti hai, toh yeh bearish signal hai aur trend reversal hone ka indication hota hai.

8. Inverse Head and Shoulders (Mudal Head and Shoulders):

Is pattern ka opposite version bhi hota hai, jise hum inverse head and shoulders kehte hain. Isme trend reversal bullish hoti hai. Is pattern mein left shoulder, head, aur right shoulder ki formation hoti hai, lekin yeh time par price neeche jaane ke bajaye upar jaati hai.

9. Trading Strategies (Trading Strategies):

Head and Shoulder pattern ko trading strategies mein istemal karne se pehle traders ko confirmatory signals ka wait karna chahiye. Agar neckline ko break karke price trend reversal ko show karti hai, toh traders apni positions ko adjust kar sakte hain.

10. Conclusion (Ikhtitam):

Head and Shoulder candlestick pattern ek powerful tool hai jo market trends ko identify karne mein madad karta hai. Traders ko is pattern ko samajhne aur istemal karne ke liye technical analysis ki sahi samajh honi chahiye. Yeh pattern market ke potential reversals ko capture karne mein madadgar ho sakta hai, lekin risk management ka bhi khayal rakhna zaroori hai.

Yeh Roman Urdu guide humein batati hai ke Head and Shoulder candlestick pattern kya hota hai aur isko kis tarah se samajh kar market trends ko predict kiya ja sakta hai. Traders ko is pattern ko sahi tareeqe se interpret karna aur confirmatory signals ka wait karna chahiye takay unko behtar trading decisions lene mein madad mile.

:max_bytes(150000):strip_icc()/dotdash_Final_Head_And_Shoulders_Pattern_Sep_2020-01-4c225a762427464699e42461088c1e86.jpg)

تبصرہ

Расширенный режим Обычный режим